Accounting for Liabilities/Assets Obtained Outside of FINSYNC

Scenario: Prior to having a FINSYNC account, a business purchases equipment for $21,000.00 and this purchase occurred outside of FINSYNC from a personal banking account. The business owner, who is the purchaser, would like to pay themselves back incrementally. In addition, because the payments are occurring outside of FINSYNC they will not be automatically applied to the outstanding balance. As a result, the business owner is not able to invoice themselves for this purchase, nor would the owed balance reflect any payments made towards it.

To account for this purchase and subsequent payments made to reduce the "owed" balance, the FINSYNC profile owner will need to do the following:

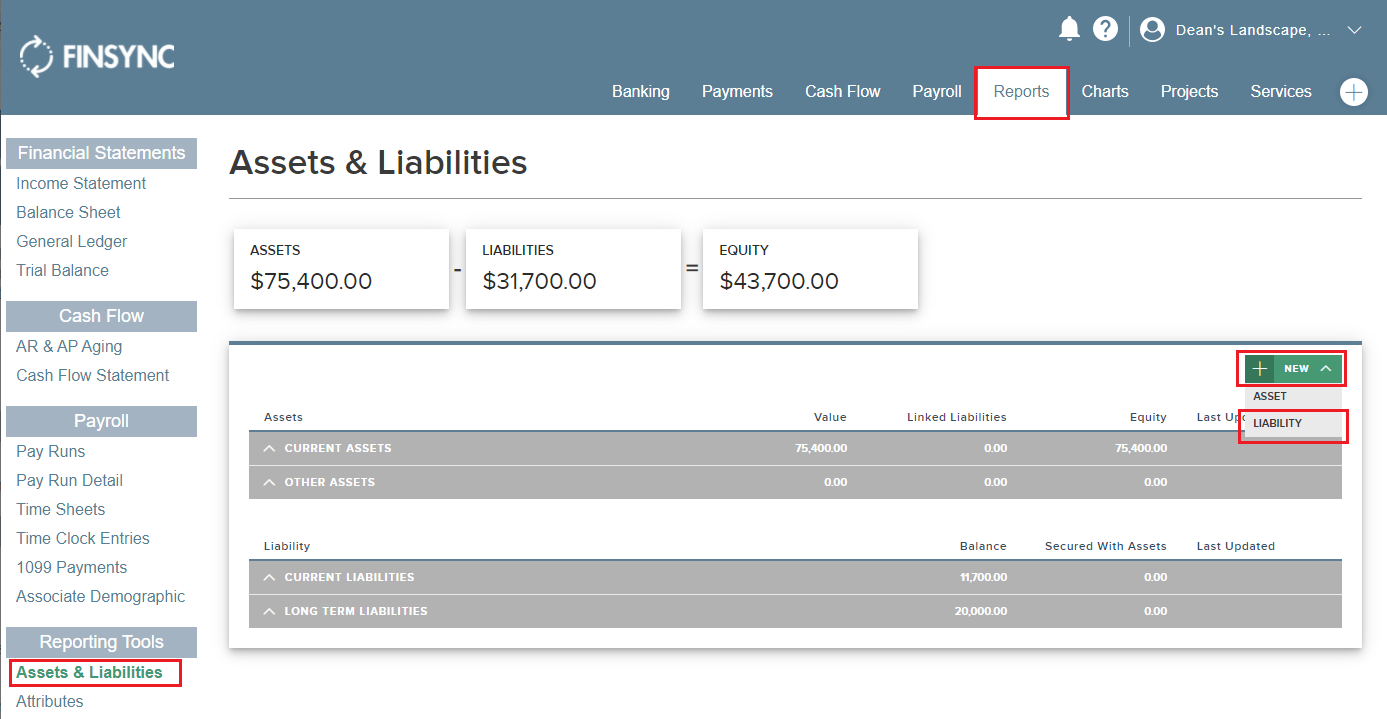

1. The FINSYNC profile owner will need to treat this purchase as a "loan" since they would like to pay themselves back. To create the "loan", click on the Reports tab found in the top menu. Once redirected, select Assets & Liabilities from the left-hand menu. Hover over the green NEW button and select LIABILITY.

2. Once the loan (stand-in for purchase) has been created, the account owner can create bill(s) in order to track payments made against the balance of the liability (loan/stand-in for purchase). To do, follow the steps outlined below:

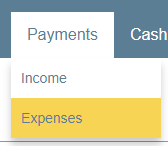

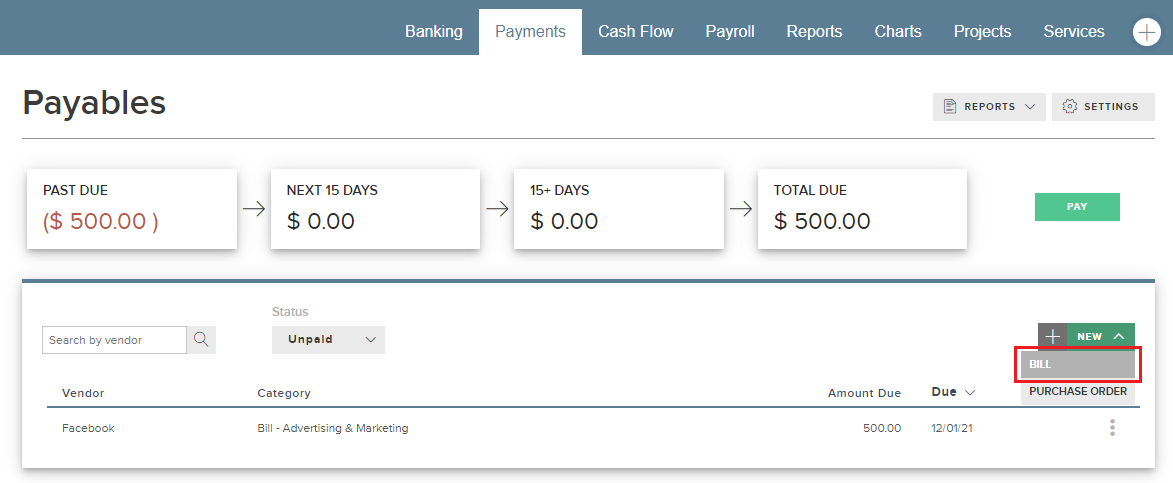

- Mouse over the Payments tab in the top menu and select Expenses. Mouse over the green New icon and select Bill.

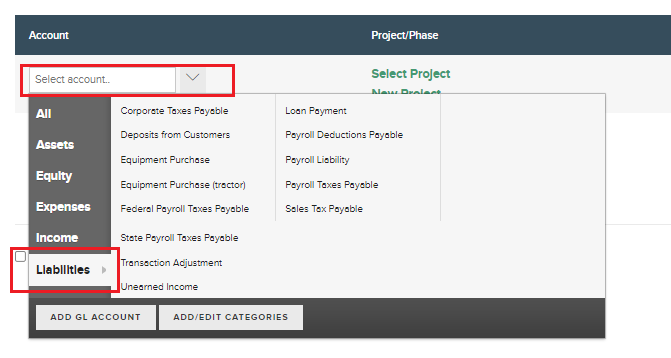

- Be sure to list the vendor as the individual who made the original purchase. You will likely need to create a vendor profile for the individual, simply use the green Add New link located next to the vendor drop down box. After filling out the other required information, be sure to use the drop down menu located underneath the Account type. From the Chart of Accounts select Liabilities and then locate the Liability you are wanting to apply the payment towards (it will be listed under the name that you designated it).

- Once you have selected the Liability, you will see several tables populate below on the bill creation page. You will need to enter the amount of the payment inside the box designated as principle.

Note: The amount of the Bill needs to match the amount entered into the Principal box.

- Mouse over the green Save button and select save and mark as paid.

Optional Recommendation:

Because of FINSYNC's banking sync feature, even though the actual payments towards the liability are not occurring through FINSYNC, the transactions will still be logged in the transaction table for the respective charge/cash account(s). These transactions will appear as Payments that are uncategorized expenses. To ensure bookkeeping is kept on tract, it is recommended that the profile owner (company owner) match the uncategorized expense transactions with the paid bills. To do so, follow the steps outlined below:

- Locate the transaction on the respective banking page where the payments are being tracked through the sync feature of FINSYNC.

- Once located, mouse over the ellipses at the end of the transaction row and select Apply to Payable.

- Locate the paid bill from the items that populate on the Matching page and toggle the check box on the row of the specific bill. Then click on the green Match button.