Handling 401k Contributions

The below article outlines how 401k contributions need to be handled/set-up within a FINSYNC profile.

During the initial onboarding phase of payroll set-up, it is important to understand if 401k contributions are being offered by our client to their associates. In order to prevent unintentional lapses in contribution payments, the below article should be consulted in order to ensure that the proper steps are taken as early as possible.

Because FINSYNC's payroll module is unable to remit the contribution amounts to the respective providers, the process of both accounting for such a benefit and actually remitting the amounts to the providers is 2 fold:

- Setting up a Benefit in order to withhold the needed amounts from the associate's wages.

- Following Bill Pay procedures underneath the Payments tab in order to properly send funds to the provider.

Benefit Set Up (Payroll Module):

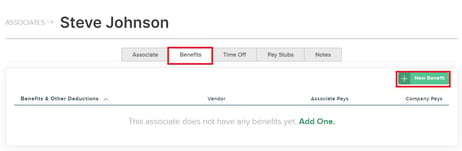

1. From the Payroll Module, select Associate Records in the left hand menu.

2. When viewing the respective Associate Record, click on the Benefit tab in the top menu.

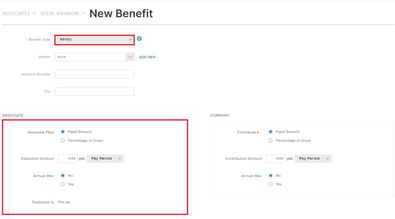

3. Select 401k as the Benefit Type and enter in the required information.

4. Save all changes that have been made.

(Optional) repeat the above steps for all associates participating in the 401k plan.

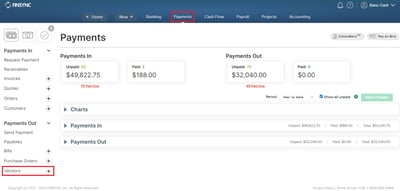

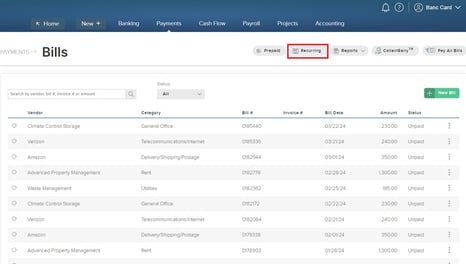

Sending Contributions/Bill Pay (Payments Module):

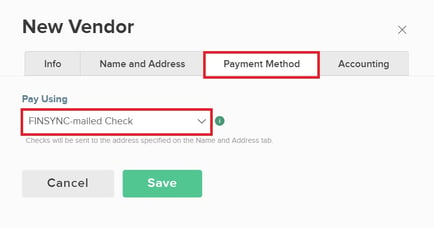

1. From the Payments Module, create a Vendor Profile for the Provider (who the contributions need to be sent to).

- The address that is listed for the Vendor needs to be the mailing address for the Provider.

- Payment Method must be set to FINSYNC - Mailed Check.

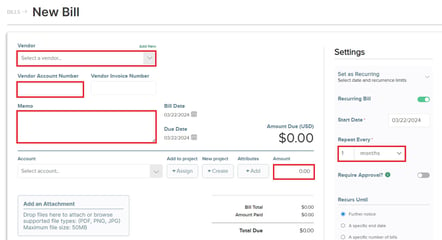

2. Create a Recurring Bill Template:

- Set the amount to be equal to that of the contribution amount.

- Set the Recurrence Settings to align with the Payroll pay periods.

- On the template, set the Vendor Account Number to to be that of the associate's account with their provider.

- On the Memo line - enter in any additional details related to the contributions.

3. The template will create bills according to the recurrence settings schedule. Users will need to navigate to the Payments tab after processing payroll, locate the system generated bill that corresponds with the pay period frequency and select the option to Pay Online.

NOTE: This process needs to be repeated every time that payroll is processed.

4. Confirm that the Provider is receiving the contribution amounts and applying them to the correct 401k account by checking through/with the proper means.