How to Set Up an Associate Record to be Commission Only

In order to set up an associate to be be paid on a commission basis only, please follow the steps outlined below:

Setting Up the Record

1. After logging into your FINSYNC profile, click on the Payroll tab in the top menu.

2. Once on the Payroll landing page, click on Associate Records in the left hand menu.

3. Click on the green New Associate button to create a new profile.

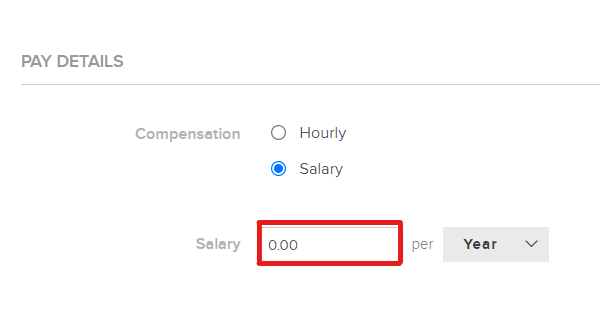

4. After completing the General Info and Tax Details section of the Associate Record, you will now be able to set up the Job & Pay Details section. It is here that you are needing to make the following selection:

- The Associate's Compensation can be either Hourly or Salary (depending on tax treatment), but the amount MUST remain $0.00 for either the Salary or the Regular Rate.

5. Complete Associate Record set up and save before navigating away from the page.

Processing Payroll

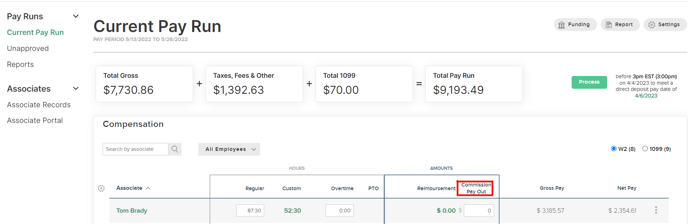

1. On the Payroll module, be sure you are on the Current Pay Run screen. If needed, click on Current Pay Run in the left hand menu.

2. Locate the row of the Associate that is needing Commission Pay to be added in for the current pay period.

3. Use the Commission text box to enter in an amount to be added onto the current pay run.

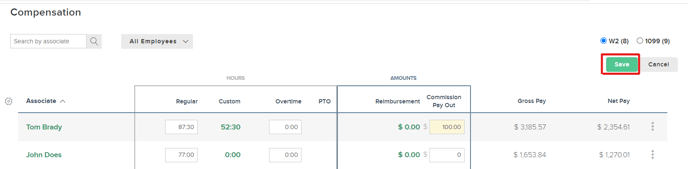

4. After entering in the necessary amount, be sure the click on the green Save button that appears underneath the W2 and 1099 switches.

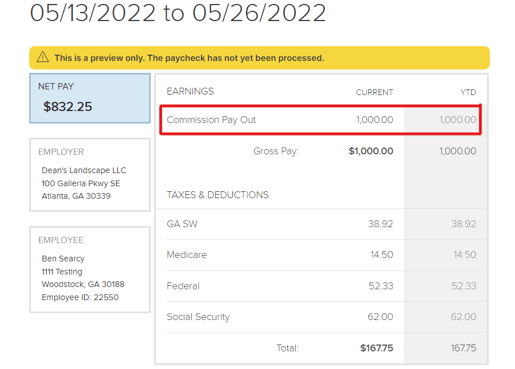

5. When payroll is processed for that amount, the Associate will receive the commission amount either in full or after taxes depending on their designated tax treatment. The amount will show as a separate line item on the Associate's Pay Stub.