Journal Entries & New Transactions on Credit Cards

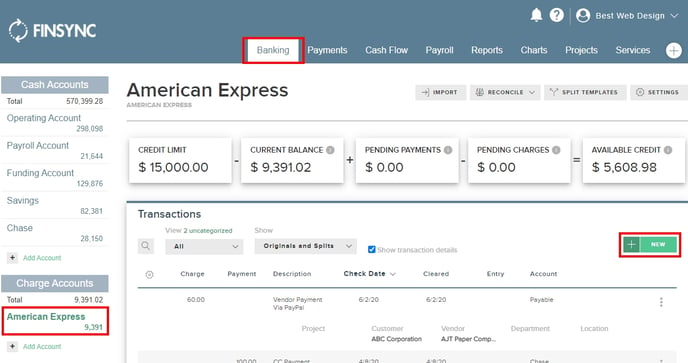

The following describes how FINSYNC links credit card accounts on the Banking tab with liability accounts on the Balance Sheet.

- If you create a credit card account on the Banking tab manually or by syncing with your bank, FINSYNC automatically creates a liability account on your balance sheet with the same name.

- Each transaction the system pulls in from the credit card sync will automatically impact the Balance Sheet as well.

- By selecting New from the credit card register within Banking, you can create an entry that impacts the balance within the Banking tab AND the Balance Sheet.

Note: This is how you should record transactions the credit card sync may omit.

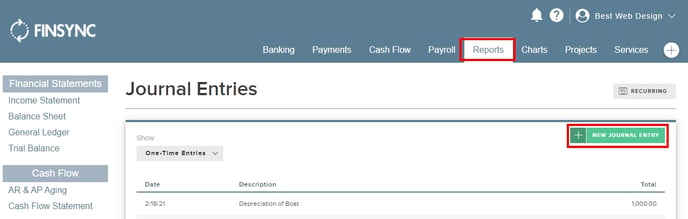

4. If you select New Journal Entry within the Journal Entries section of reports, you can choose your credit card liability account as part of the entry, but that entry WILL NOT impact that credit card account on the Banking tab.

Note: Users who have imported data from QuickBooks or other systems may have brought in credit card ledger data with corrections made by a Journal Entry for missing transactions. The steps to get the credit card balance from the Banking tab to match with the balance sheet credit card liability section are:

1. Reverse or delete those corrective Journal Entries on the Journal Entries section of the Reports tab.

2. From the Banking tab, choose the credit card and select New to create the missing transaction with a cleared date of where it should appear in reporting.

3. Once saved, the transaction will impact the balance on the credit card portion of the Banking tab and the balance sheet liability section for that credit card.