Save Time with Automated Categorization for Bank Transactions

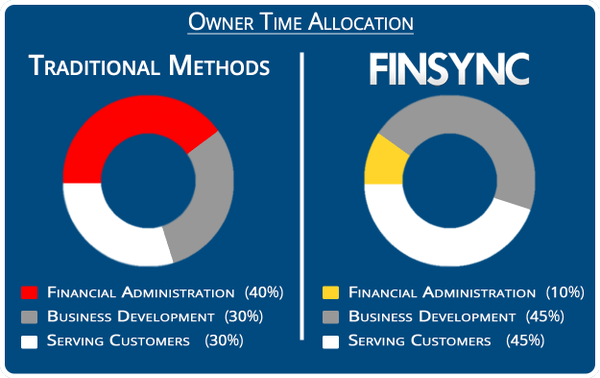

FINSYNC gives you powerful tools to reduce your overall time spent on administration related tasks time and to quickly formulate strategies based on real-time analytics.

One big way to reduce your administrative time is to leverage all of the tools FINSYNC offers to automate the import and categorization of bank transactions.

Here are some tips:

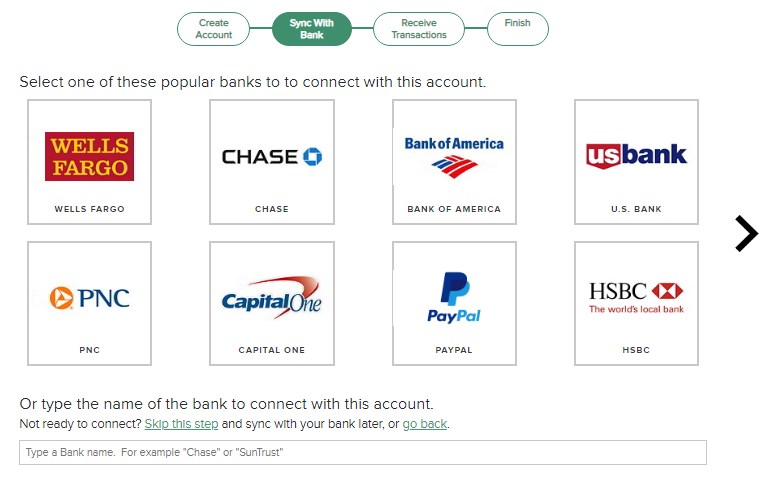

1. Sync Your Bank and Credit Card Accounts

Traditional accounting systems require a lot of labor to get all of your transaction-level data input. Some systems require users to hand key each transaction and others at least allow you to upload transactions in comma separated value files (.csv). You first must visit your bank page to download your transactions.

On top of being labor intensive, these systems virtually guarantee your books are never up to date.

That said, take advantage of FINSYNC's ability to sync with your bank and credit card providers.

When you sync accounts, your transactions are automatically imported every night! Note: if your bank uses multi-factor authentication, you'll need to hit the refresh button when you log in, and then answer your security questions.

2. Leverage the Income and Expenses modules of FINSYNC.

When you create your invoices through FINSYNC, you won't need to go back and create a receivable. The system does this for you. When your customer pays you, you don't need to mark the invoice as paid; the system does that, too.

Another great benefit of using invoices through FINSYNC is that you are already telling the system what type of income will be earned through that invoice when you create it.

When your customer pays through FINSYNC, the resulting income is then automatically categorized to the correct GL account!

Bill Pay works the same way. You choose the general ledger account when you create the bill. The accounting happens automatically as the payable is wiped out and your cash is reduced in the bank.

3. For Other Transactions, Teach the System to Categorize for You

FINSYNC has an algorithm that learns how you categorize transactions.

When transactions are imported from your bank and credit card accounts, the category (GL account) assigned by the bank is used to choose the correct category in FINSYNC. Not long after you start changing or assigning categories, you'll see that the system starts automatically suggesting those categories going forward!