Understanding the Cash Flow Dashboard

Review the information outlined below on how to use the FINSYNC Dashboard to track cash flow:

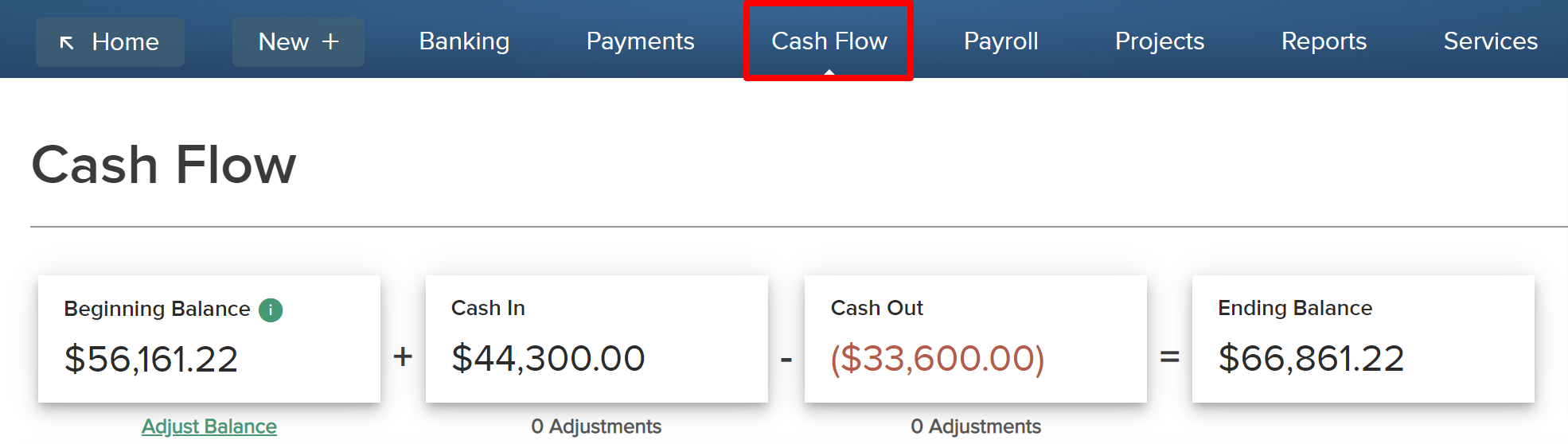

1. Select Cash Flow icon in the top menu to access the Cash Flow Dashboard.

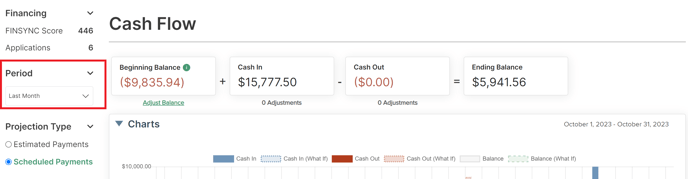

2. The top bar is a summary view of the period you are actively viewing. By default, it shows the Current Month but you can set the period to any time period you prefer. To do this, select the drop down on the left menu under Period.

- Beginning Balance is how much money was in your cash account(s) at the beginning of the period.

- Cash In is all the money that has already or is scheduled to come into your accounts before the end of the period. Note: Cash In is not the same as Income. You may have cash inflows of other types.

- Cash Out is all the money that has already or is scheduled to flow out of your accounts prior to the end of the month. Note: Cash Out is not the same as Expenses. You may have other types of cash outflows.

- Ending Balance is how much you are anticipated to have at the end of the period based on what is tracked and recorded within FINSYNC.

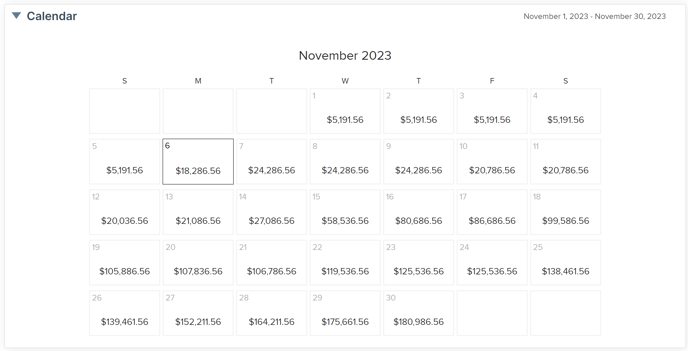

3. The Calendar shows you how much money you had or are anticipated to have each day throughout the selected time period. Select the drop down on the left menu under Period to choose your time period.

The dollar amount shown on each day represents how much cash FINSYNC calculates you will have on the day in question.

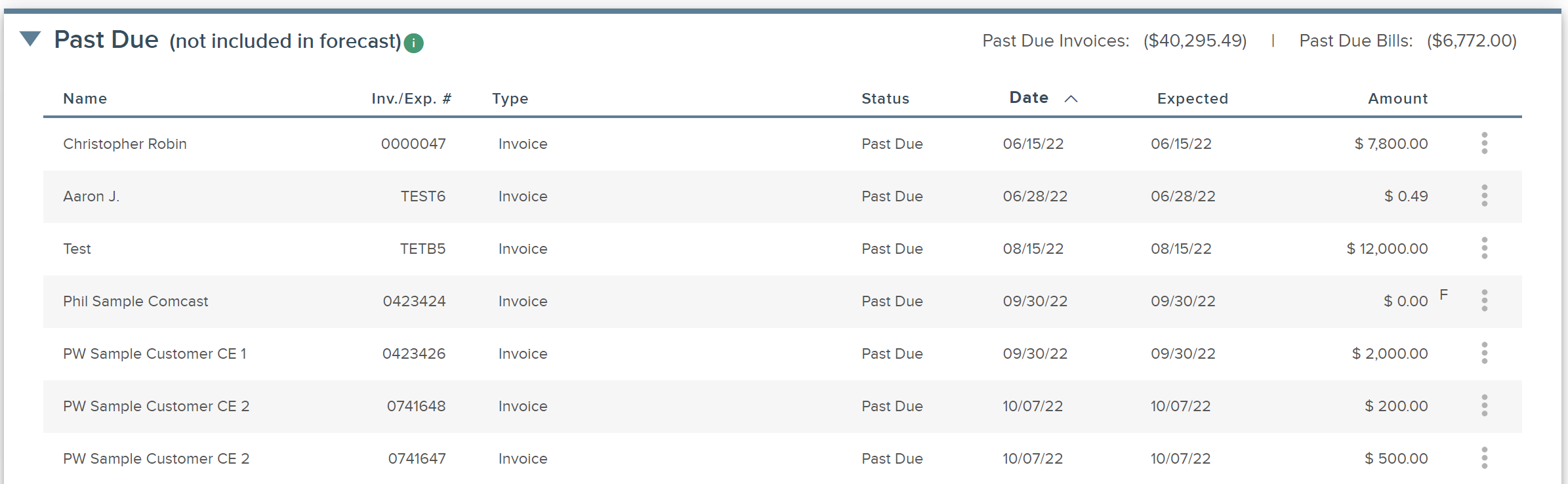

The Past Due section represents items that were scheduled to happen in the past but have not actually happened. You can always update the items to better model your cash flow.

The Cash In section shows you items that FINSYNC is aware will happen such as invoices that your customers are due to pay before the end of the period you are viewing. You can also Select New Adjustment to create an item that FINSYNC is not aware of such as cash generated by owner capitalization or the sale of a piece of equipment or real estate.

The Cash Out section represents everything that FINSYNC is aware will happen such as bills that you plan to pay your vendors or payroll related expenses due before the end of the period you are viewing. You can also select New Adjustment to add items that FINSYNC is not aware of such as owner draws or anticipated bonuses.