Verifying Payroll and Vendor Information (W2 and 1099) for Year End Activities

As part of year end activities and in preparation for any tax filing/reporting, FINSYNC recommends each business verify key information related to payroll and vendor activities to ensure accuracy for any annual W2 and 1099 reporting.

The following topics cover the key areas to review. Click on any of the following topics to jump to the applicable section in this article, or scroll down to see each section and steps to verify information for year end activities:

Businesses using FINSYNC 'Payroll' (W2 or 1099 Associates)

1. Payroll Tax & Unemployment Information

2. Payroll Associate Information (W2 or 1099)

3. Availability and Fees for Payroll Related W2s / 1099s

Businesses using FINSYNC 'Payments' to Pay Vendors as 1099

4. Vendor Information and Settings for 1099 Tracking

5. Run '1099 Payments' Report to Verify Vendors for 1099

Business using FINSYNC 'Payroll' (W2 or 1099 Associates)

1. Payroll Tax & Unemployment Information

Note Regarding Yearly Rate Determination Letters

For any state where you are subject to reporting wages for unemployment tax purposes and have a registered/active employer account, you will (or may have already) received a yearly rate determination notice that will reflect your tax rate for the upcoming year. This may also include changes to the payroll tax payment frequency.

If you receive any notices related to the above information, please do not update any information directly in FINSYNC.

If you receive any notices payroll tax information, please provide them to FINSYNC using the following link. FINSYNC will contact you to review and confirming the timing for any changes in FINSYNC: Upload your documents

Review and Verify Payroll Tax Information for the Current Year

1a. Review to ensure the Payroll Tax information is correct for the current year current year

- If any information is incorrect for the current year, do not update any information directly in FINSYNC. Please contact FINSYNC immediately to review any changes and implications to Payroll Tax for the current year.

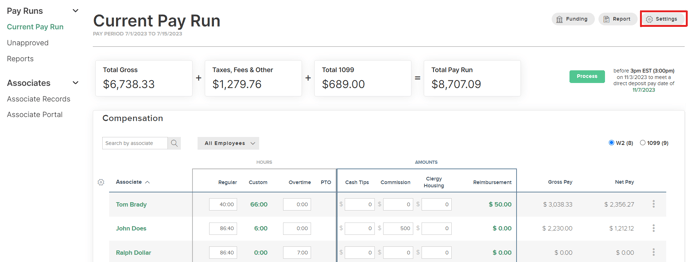

1b. Click Payroll in the main menu.

1c. Click on the gray Settings button in the upper-right portion of the screen.

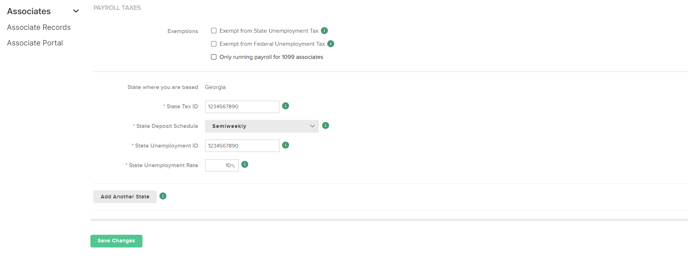

1d. Scroll down on the Settings page to the Payroll Tax section.

Review the information under the Payroll Tax section for accuracy.

If any information is incorrect for the current year, do not update any information directly in FINSYNC. Please contact FINSYNC immediately to review any changes and implications to Payroll Tax for the current year.

2. Payroll Associate Information (W2 or 1099)

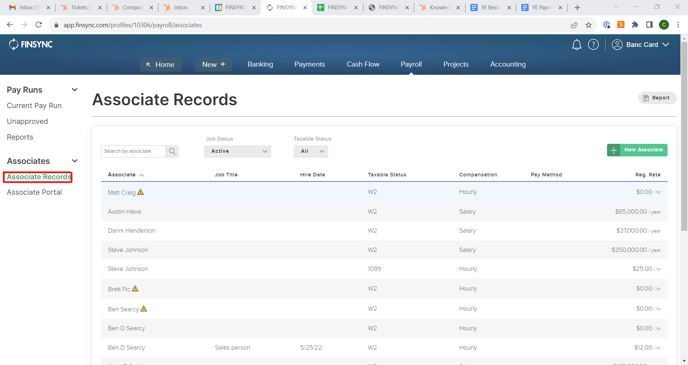

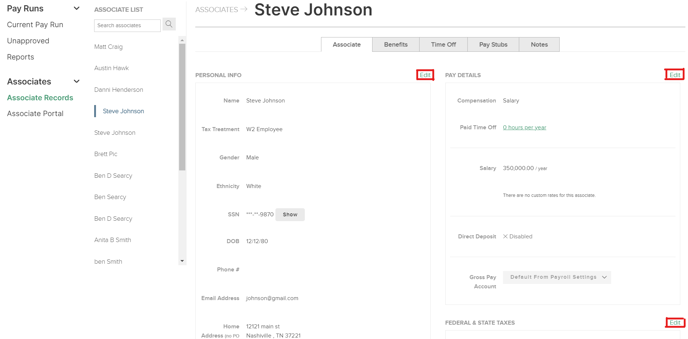

2a. Click Payroll in the main menu. Then click Associate Records on the left-hand menu.

2b. Click on each associate to view their information and make any adjustments if needed.

Use the Edit button next to the respective sections of the Associate Record to make any necessary adjustments. Be sure to click the green Save button to save and confirm the changes.

3. Availability and Fees for Payroll Related W2s / 1099s

W2's: FINSYNC will automatically generate W2's and will be sent to customers by the end of January.

1099's: FINSYNC will automatically generate and mail 1099s for independent contractors you pay through our payroll system. Preparation includes:

- Printing and mailing a copy of the 1099 to the address on record of the vendor

- Providing an electronic copy of the 1099 to your firm for your records

Fees (billed separately from your regular monthly charges):

- $55 base processing fee

- $6 per W2 or 1099 for employees / contractors / associates paid through Payroll module

Business using FINSYNC 'Payments' to Pay Vendors as 1099

4. Vendor Information and Settings for 1099 Tracking

Specific settings need to be in place within FINSYNC for any vendor paid and to be tracked as 1099. Please review the vendor record information and 1099 settings for accuracy.

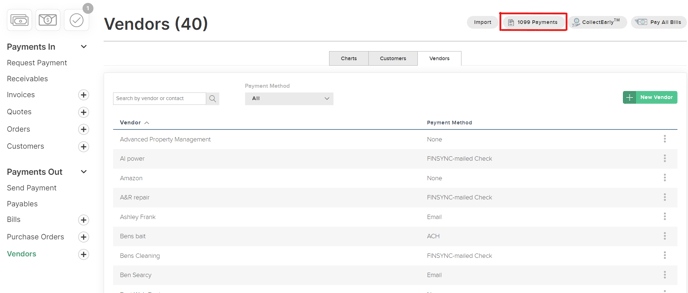

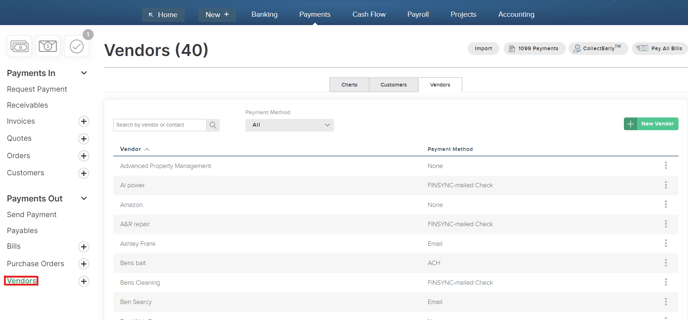

4a. Click Payments in the main menu and then click Vendors in the left-hand menu.

4b. Click on a vendor from the list in order to verify and edit the information as needed.

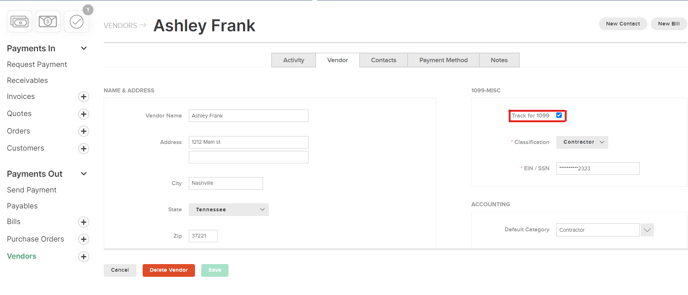

- For any vendor paid as 1099 using FINSYNC Payments (Bill Pay), please ensure that Vendor record is also set up for 1099 tracking.

- To enable 1099 tracking, check the box for Track for 1099 and then enter in the required information.

- Be sure to click the green Save button to save and confirm the changes.

5. Run '1099 Payments' Report to Verify Vendors for 1099

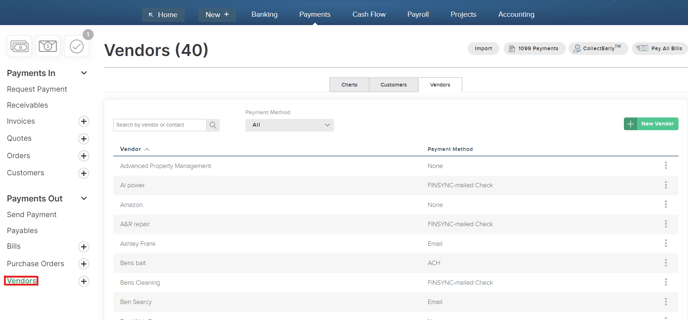

5a. Click Payments in the main menu and then click Vendors in the left-hand menu.

5b. Click the 1099 Reports button in the upper-right portion of the screen to run a report that will verify all vendors are being tracked for 1099.