Verifying Your Payroll Information for Year End Reports

As part of Year End reporting/filing it is always good to verify your Business -Payroll information is accurate and this would include the following:

Associate Information:

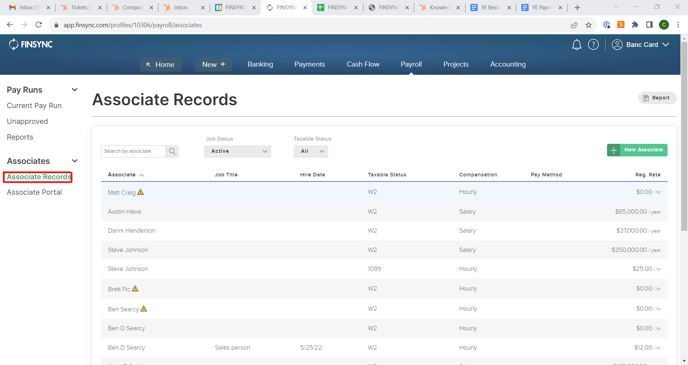

1. On the Payroll tab, click on Associates Record in the left-hand menu.

-

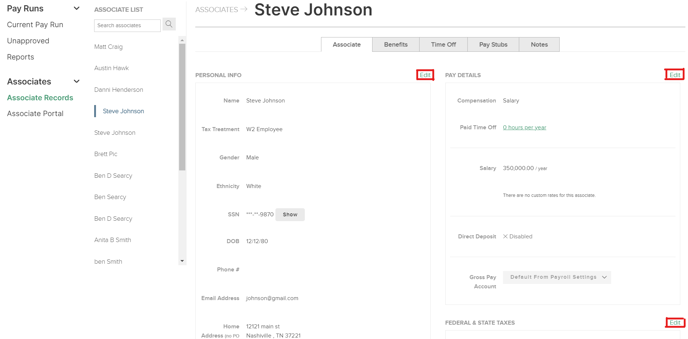

- Use the Edit button underneath the respective areas of the Associate Record to make any adjustments/changes that are needed.

- Use the Edit button underneath the respective areas of the Associate Record to make any adjustments/changes that are needed.

1099 Tracking:

For any 1099 that is not being paid via FINSYNC's Payroll module you'll need to ensure that Vendor record is set up for 1099 Tracking. These Vendors would be located underneath the Payments tab (not Payroll) and these Vendors would be receiving "Bill Pay" as opposed to specifically Payroll funds.

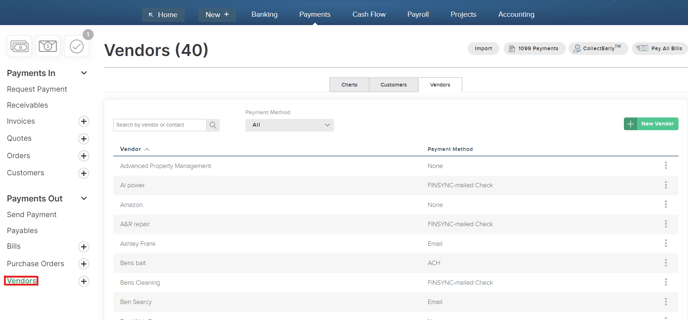

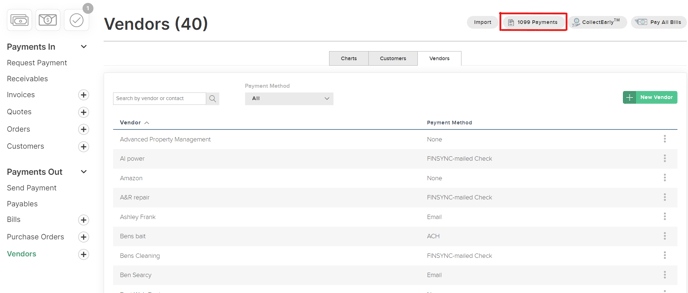

1. Click on the Payments tab in the top menu and then select Vendors in the left-hand menu.

2. Click on the 1099 Reports button in the top right of the screen to check for all Vendors that you are currently tracking for.

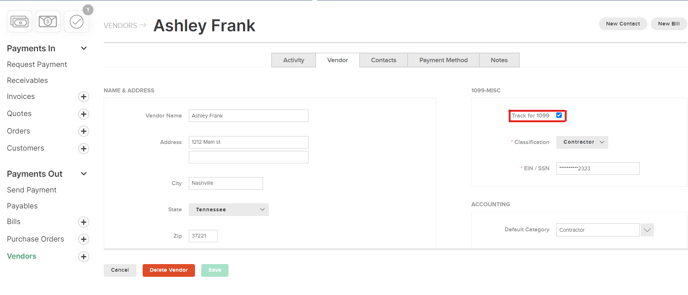

3. If you need to set up another Vendor for Tracking, click on the row of the Vendor from you list.

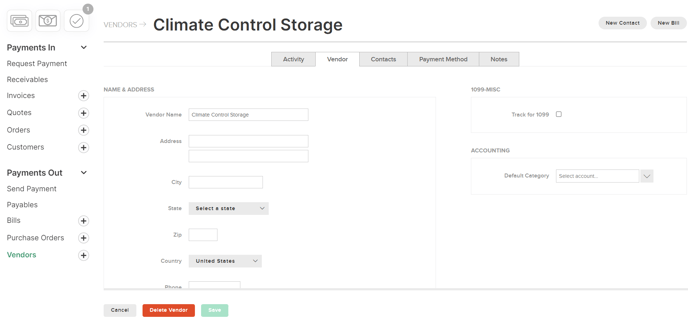

- When viewing the Vendor Record - check the box for 1099 Tracking and then enter in the subsequent, required information.

Vendor Information:

For Vendors that you are tracking for 1099s - you'll want to ensure that the Vendor Record information that is listed in the FINSYNC profile is accurate:

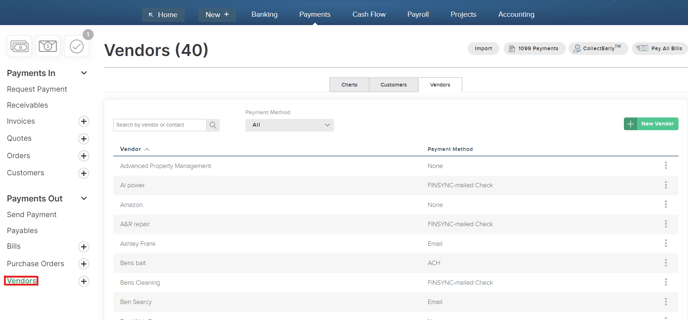

1. Click on the Payments tab in the top menu and then select Vendors in the left-hand menu.

2. Select a Vendor from the list by clicking on the respective row in order to verify and edit the information as needed.