Verifying your Unemployment Information

If you have an active unemployment payroll tax account you will (or may have already) received a yearly rate determination notice that will reflect your tax rate for the upcoming year. Additionally, you may receive a notice from the IRS or State that your tax payment frequency has changed.

Updating Payroll Tax Information:

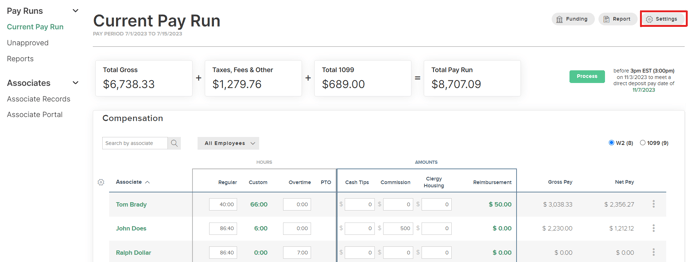

1. Click on the Payroll tab in the top menu.

2. Click on the grey Settings button near the top right corner of the screen.

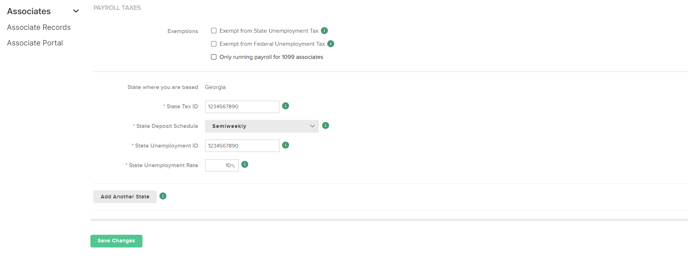

3. Scroll down on the Settings page until you are viewing your Tax information.

- Make any necessary changes and be sure to use the green Save button to confirm the changes.

4. For any and all notices that you may have received, please upload those HERE: