How to Handle Bulk Cash and Check Deposits in Your FINSYNC Profile for Multiple AR Items

FINSYNC automatically handles your AR & AP items that are processed through/by FINSYNC. However, Invoices or Bills that are paid with checks or cash outside of your FINSYNC will need to be handled manually.

Note: The below article assumes your Bank Accounts are SYNCED with FINSYNC.

When your customers consistently pay your invoices with either checks or cash, your FINSYNC profile will need your help in correctly identifying them and recording payments to ensure accurate reporting. FINSYNC recommends the below actions are followed to ensure the listed balances and reports in your FINSYNC profile are reliable.

Note: If you deposit checks/cash individually, click HERE to navigate to the correct article.

Note: When depositing lumpsum amounts (either checks or cash) these items will only show up as one deposit transaction in your bank register. It is this single transaction that will be reported to FINSYNC. In other words, just as your bank only recognizes one lumpsum deposit, the same is true for your FINSYNC account.

- You MUST keep a register external to FINSYNC of what invoices and the respective checks are part of a lumpsum deposit.

- EX: If you deposit 10 checks totaling $1000.00, both your bank and FINSYNC does not know which 10 checks are represented in the single deposit of $1000.00. When it comes to the below steps, you will need to know which invoices are needing to be marked as paid when being matched with the lumpsum deposit.

Once the deposited item(s) have cleared your bank:

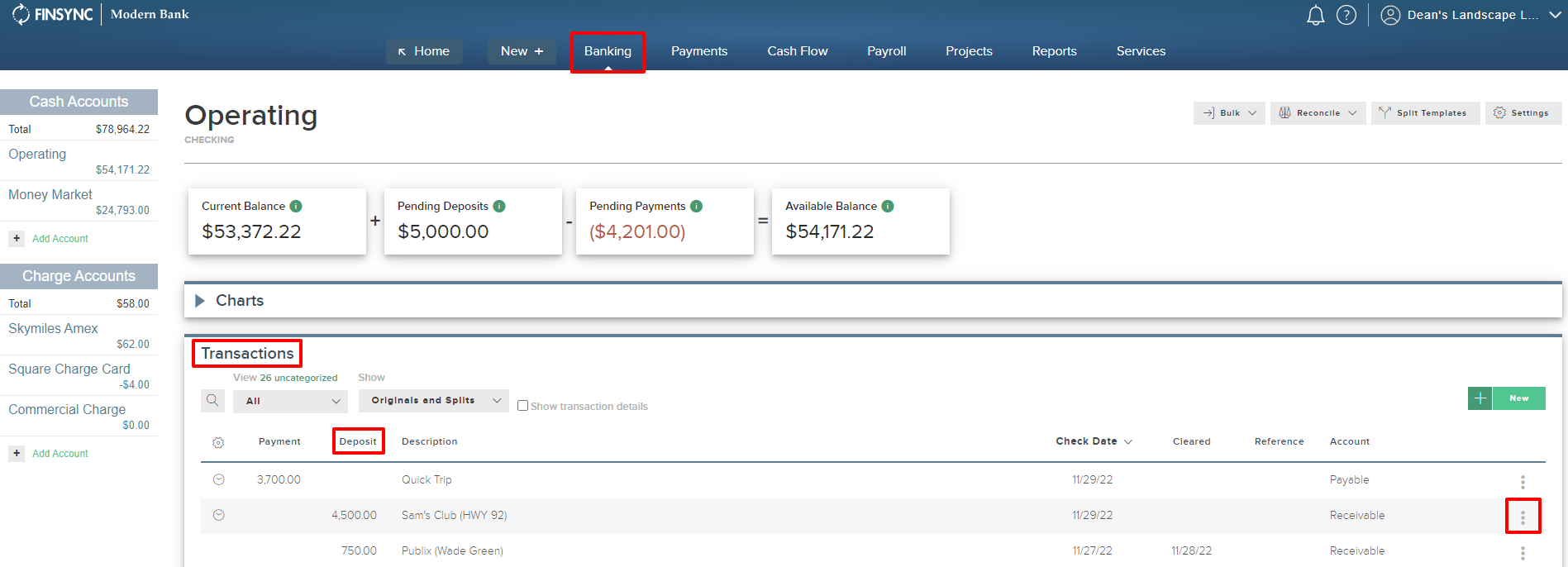

1. Locate the Deposit Transaction on your Banking page.

2. Mouse over the ellipses at the end of the row of the transaction and select Apply to Receivable.

.png?width=271&height=264&name=Screenshot%20(33).png)

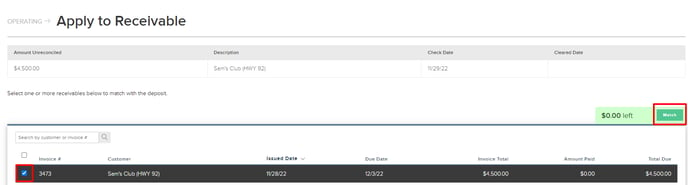

3. The system will generate all Invoices that are currently listed as UNPAID in your FINSYNC profile. Select the correct invoices that are needing to be marked as paid based on the ledger you created when depositing the lumpsum checks.

All selected invoices will now be marked as Paid in FINSYNC with a Payment Recorded note in the Invoice History.