Using the 1099 Payment Report

The 1099 Payment Report is where you can see your activity with all or a subset of your 1099 contractors over a period of time.

Note: In FINSYNC when you pay a 1099 contractor through the Expenses tab, they are considered to be a Vendor. When you pay a 1099 contractor through the Payroll tab, they are considered to be a 1099 Associate.

The various settings on the 1099 Payment report are as follows:

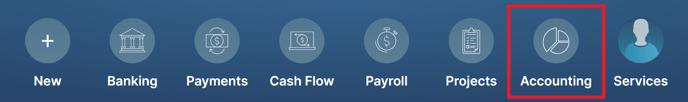

1. Select Accounting from the top menu.

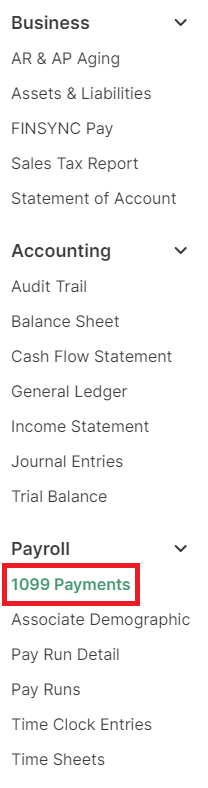

2. Select 1099 Payments from the bottom of the left menu under Payroll.

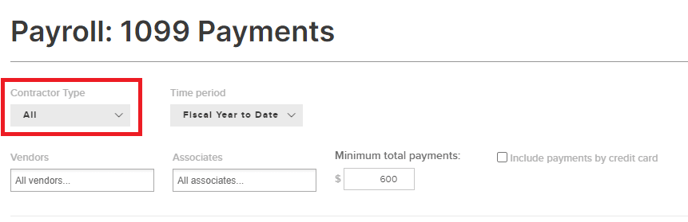

3. The first dropdown defaults to All, which means it will show payments to both 1099 Associates and Vendors. If a person was paid as both (through Expenses and Payroll), those payments will need to be summed to get the total for the period.

You can choose to only show Vendors or only show 1099 Associates.

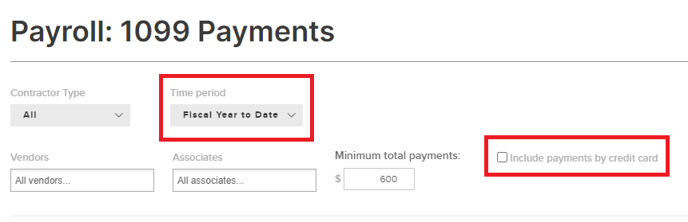

4. You can use the Time Period dropdown to select the specific period you want to review. If you want to verify what various contractors should show on their 1099 filings, you should choose the following:

Contractor Type: All

Time Period: Last Fiscal Year

Check: Include payments by credit card

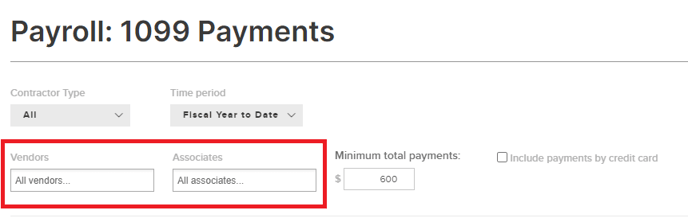

5. If you want to look at individual contractors, you can use the Vendor and 1099 Associate fields to search for them specifically.

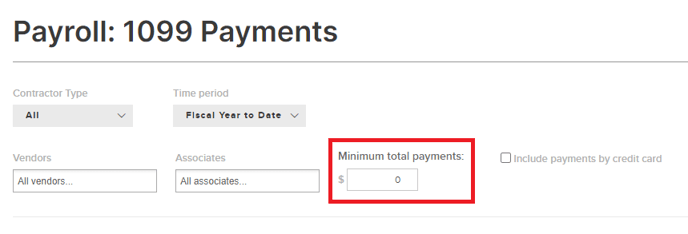

6. You can switch the Minimum total payments field to $0 if you want look at every single entity you marked as 1099.

Related Articles:

How to Track Payments using FINSYNC's Pay Report

How to Track 1099s for Vendors

What Your Vendors See When You Pay Them