How to Track 1099s for Vendors

Your FINSYNC profile allows you to track vendors for 1099s when using the Bills feature for paying a vendor.

This article will show you how to set up 1099 tracking for new Vendors and how to edit tracking for existing Vendors.

Setting up 1099 tracking for a New Vendor:

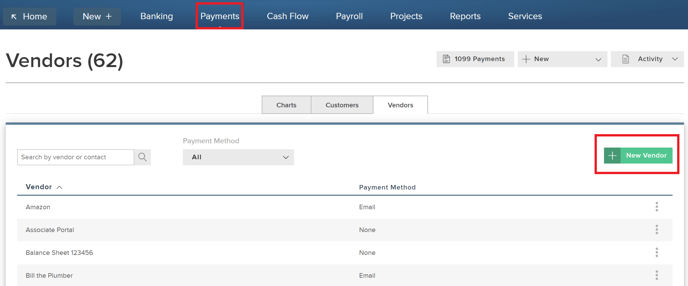

1. Select Payments at the top and then click Vendors from the bottom left menu.

2. Select + New Vendor on the right.

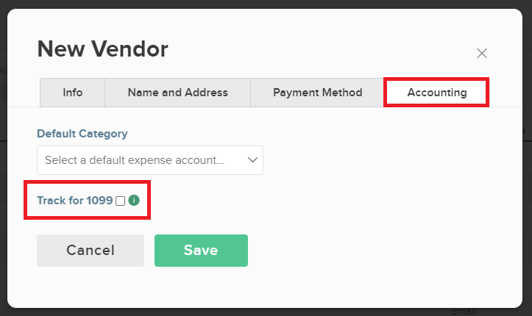

3. First add the vendor name and email address. Once completed, select the Accounting tab on the far right.

- Select the checkbox Track for 1099

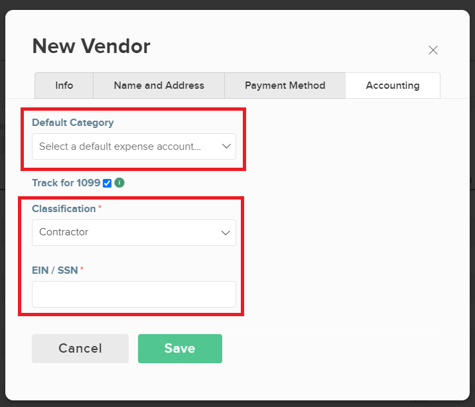

- Once you select the checkbox, you will see additional information pop up for you to fill out. Enter the Default Category, the Classification and also the EIN/SSN for the vendor.

- Select Save.

Editing 1099 tracking for an Existing Vendor:

1. Select Payments at the top and then click Vendors from the bottom left menu.

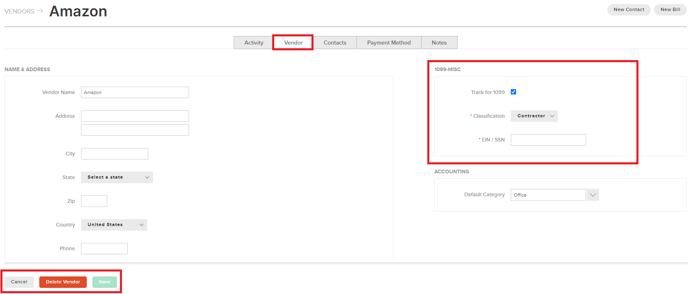

2. Locate the vendor in the list and click on the row for the specific vendor to edit.

3. On the vendor summary screen, select the checkbox Track for 1099 on the right hand side.

4. Enter the EIN/SSN for the vendor.

5. Select Save to complete.

Related Articles:

What Your Vendors See When You Pay Them